Profile

Blog | 6 min read

December 7, 2021

Business trends continue to shift since the onset of the COVID-19 pandemic. To protect the health and safety of employees, many private sector companies closed offices and sent their employees to work from home. Many employees have since returned to the office, though not exactly as they would have pre-pandemic and at varying levels across the nation. For example, employees in New York are returning at slower rates than other less congested areas. Additionally, some companies are returning to smaller offices and an increasing number of companies are establishing Hub & Spoke locations in new markets.

In addition to hybrid work, the Hub & Spoke business model is gaining traction among companies re-evaluating office space, especially in major metros like New York where companies pay steep operational costs. In a Hub & Spoke model, the ‘hub’ signifies a main headquarters location while ‘spokes’ represent smaller, regional offices. This model is attractive to companies looking to decentralize and to establish specialty offices.

The Hub & Spoke model also provides companies access to top talent in several different locations and provides flexibility for both employers and employees. It can also provide operational redundancy in case of public health emergencies, natural disasters and other issues.

Hub & Spoke office locations are becoming more prevalent as COVID leads more companies to re-evaluate both where and how employees work. According to recent data from CoStar and a survey from the Partnership for New York City, one third of the major employers based in New York anticipate reducing their office space in the next five years. Furthermore, 34 percent of all companies based in New York expect to need less space in the city altogether. The percentage of New York-based firms expecting to reduce space is even higher in certain industries:

Some companies in New York are forced to consider downsizing employees as well as office space. According to CoStar, 13 percent of businesses expect to reduce the size of their workforce in the next five years. Among the industries surveyed, financial service firms reported anticipating the highest reduction in workforce at 22 percent.

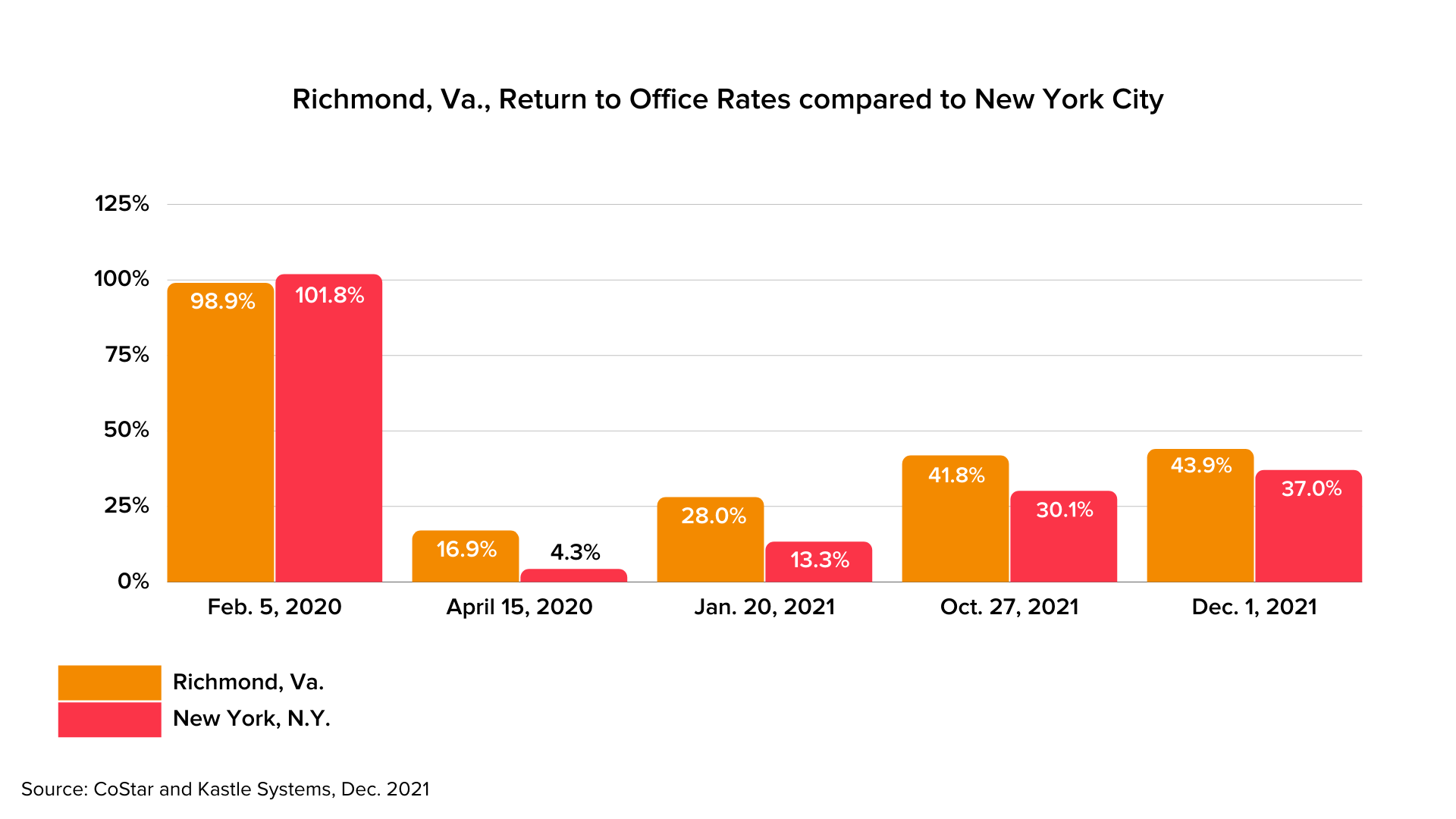

Recent data shows workers in Richmond, Va., are returning to work at a quicker rate than employees in New York City. Based on the number of badge swipes, Kastle Systems found more Greater Richmond-based workers are entering the office post-pandemic more often than employees in New York City. The most recent data from early December reveals 43.9 percent of employees in Greater Richmond work in the office compared to only 37 percent of New York City employees.

Furthermore, additional data gathered by CoStar and Kastle Systems shows the percentage of Richmond workers who have returned to their offices is above the average for the nation’s 10 largest office markets: Austin, Texas; Washington, D.C.; New York; Dallas; Los Angeles; San Francisco; Houston; Philadelphia; Chicago; and San Jose, Calif.

Some employees have not yet re-entered the office because their employers offer hybrid work models, allowing employees to split time between workplaces and home offices. CoStar’s research reveals most employees currently choose hybrid schedules. On an average weekday, just 28 percent of employees based in Manhattan work in their office while only 8 percent work in the office five days a week. Additionally, more than half of New York workers remain fully remote at 54 percent.

Hybrid work models appear to be a lasting result of the pandemic as many companies expect to offer remote work permanently. New York companies anticipate 49 percent of employees to be back in the office on an average weekday by Jan. 30, 2022. Fifty-seven percent of workers are expected to work in the office at least three days a week and 21 percent of those workers will remain fully remote until at least the end of January. The decision to prolong remote work is in part a result of the COVID variants but is also due to employee preference. Thirty-three percent of companies report offering remote work to meet employee preference.

With research headquarters based in Greater Richmond, leader in commercial real estate data CoStar initially offered hybrid work and has since been welcoming its employees back into the office. According to Lisa Ruggles, CoStar’s senior vice president of global analytics, research and news, “CoStar’s more than 1,000 Richmond-based employees returned to the office in mid-April from remote working and have remained there since.” In addition to thriving off the region’s workforce, CoStar also benefits from Greater Richmond’s available real estate. “We opened our second and third offices in Richmond over the past six months, bringing CoStar’s total office-using footprint to just over 231,000 square feet in downtown Richmond. That is more than a 200 percent increase in the past five years.”

Why should companies establish their hub or spoke locations in Greater Richmond? As the capital of Virginia, CNBC’s #1 state for business, Richmond is well-poised for both Hub & Spoke office locations. The region is home to 12 Fortune 1000 company headquarters, more than any other mid-size market, in addition to several large regional offices.

Capital One, with 13,000 workers, is a major employer in Greater Richmond that operates a Hub & Spoke model. Although headquartered in Northern Virginia, Capital One operates its corporate campus in Greater Richmond with even more employees than its HQ. Capital One has found success in Greater Richmond’s growing business community which thrives thanks to the Commonwealth’s pro-business climate, world class workforce and affordable costs of living and doing business.

McKesson Medical Surgical also operates a Hub & Spoke model within the region and greatly values the local workforce. According to Stanton McComb, President of McKesson Medical Surgical, “McKesson has benefitted from the diverse talent pool in Greater Richmond. It has been a strategic advantage for us.” Greater Richmond’s workforce is diverse, educated and growing. As Greater Richmond’s population increases, so does the local workforce.

Recent data from the U.S. Census Bureau shows residents are moving into the region from within the U.S. and abroad at higher rates than the national averages. Once located in the region, it’s easy for workers to learn new skills or to change career paths with several local workforce development programs.

Lastly, Greater Richmond is more affordable than many larger metropolitan areas. According to the Council for Community and Economic Research’s 2020 Cost of Living Index, Richmond, Va., has an average cost of living of 96.5, more than three points below the national average. New York, on the other hand, has an average cost of living of 178.8 and ranks more expensively in each category, like groceries, housing and utilities, than Richmond. New York-based companies seeking to cut costs while establishing Hub & Spoke locations will find success operating in Greater Richmond.